Arsip Kategori: chapter 3 Production Economics

APPENDIX: INTEREST

Basic concepts

Money is considered to possess a time value because when money is borrowed for a period of time, it is expected that the amount paid back will be greater than that which was borrowed. The difference is refened to as interest. The amount of interest is determined by three factors: the length of time the money was borrowed, the interest rate, and whether simple interest or compound interest was used to compute the amount. To explain these factors, let us concem ourselves with the difference between simple and compound interest.

SIMPLE INTEREST. The interest rate is generally expressed in terms of an annual rate. To compute the interest for a certain amount of money borrowed for exactly 1 year, the amount is multipled by the interest rate. We can reduce this to the following formula :

I = Pi

where i = annual interest rate

P = principal (the starting amount)

I = interest

With simple interest, when an amount of money is borrowed for a period greater than 1 year, the interest charge is determined by multiplying the yearly interest charge by the number of years :

I =Pni

where n represents the number of years. The amount of money paid back at the end of n years can be determined from the formula

![]() where F represents the future amount to be paid, in this case under simple interest

where F represents the future amount to be paid, in this case under simple interest

COMPOUND INTEREST. With simple interest, the amount I is directly proportional to the length of time n. If interest is compounded during the length of time, the final amount F (principal plus interest) grows at a faster rate. To illustrate compound interest, consider the manner in which a savings account might grow if the interest were compounded annually. Using an initial deposit of $1000 and an interest rate of 5%, the savings account at the end of the tirst year would be worth

F1 = $1000 ( 1 + 0.05 ) = $1050

This amount is used to compute the interest for the second year. Thus, the savings would have grown by the end of the second year to

F2 = $1050 ( 1 + 0.05 ) = $1102.50

The general equation for calculating the future equivalent of some present value P can be determined by the equation

![]() ln engineering economy calculations, compound interest is almost always used because it reflects more accurately the time value of money.

ln engineering economy calculations, compound interest is almost always used because it reflects more accurately the time value of money.

Interest factors

Equation (A3.2) represents one of six common interest-rate problems: the problem of computing the future wonh of some present value, given the rate of retum i and the number of years n. There are a total of six of these problems. They occur frequently enough that an interest factor has been defined to cover each problem. ln the paragraphs below the six interest factors are described.

1. Single-payment compound amount factor (SPCAF). This is the case we have previously considered: finding the future value F of a present sum P As the reader can deduce from Eq. (A3.2), the formula used to calculate the single-payment compound amount factor is

![]() We shall adopt the following notation for the SPCAF, which will be easier to remember and use than the name of the factor :

We shall adopt the following notation for the SPCAF, which will be easier to remember and use than the name of the factor :

![]() The terms in parentheses can be read: Find F, given P, i, and n. This general form will be used for the interest factors that follow.

The terms in parentheses can be read: Find F, given P, i, and n. This general form will be used for the interest factors that follow.

2. Single-payment present worth factor (SPPWF). This is the inverse of the previous interest problem. The SPPWF is used to compute the present worth of some future value.![]() 3. Capital recovery factor (CRF). Instead of paying off a borrowed sum With a single future payment, another common method is to make unifomi annual payments at the end of each of n years. The amount of each payment is ngured to yield the required interest rate i. The capital recovery factor is designed specifically for this case.

3. Capital recovery factor (CRF). Instead of paying off a borrowed sum With a single future payment, another common method is to make unifomi annual payments at the end of each of n years. The amount of each payment is ngured to yield the required interest rate i. The capital recovery factor is designed specifically for this case.

![]() where A represents the amount of the annual payment.

where A represents the amount of the annual payment.

4. Uniform series present worth factor ( USPWF ). This solves the preceding problem in reverse : finding the present value of a series of n future end-of-year equal payments.

![]() 5. Sinking fund factor (SFF). “Sinking fund” refers to the situation in which we want to put aside a certain sum of money at the end of each year so that after n years, the accumulated fund, with interest compounded, will be worth F. The sinking fund factor allows us to determine the amount A to be put aside each year.

5. Sinking fund factor (SFF). “Sinking fund” refers to the situation in which we want to put aside a certain sum of money at the end of each year so that after n years, the accumulated fund, with interest compounded, will be worth F. The sinking fund factor allows us to determine the amount A to be put aside each year.

![]() 6. Uniform series compound amount facror (USCAF). The reverse of the preceding problem arises when it is desired to know how much money has accumulated after n years of uniform annual payments at interest rate i.

6. Uniform series compound amount facror (USCAF). The reverse of the preceding problem arises when it is desired to know how much money has accumulated after n years of uniform annual payments at interest rate i.

![]() TABLES OF INTEREST FACTORS. lnstead of calculating the value of the interest factor needed in a given problem, values are tabulated for a wide variety of interest rates and years. In this appendix, the interest factors are given for interest rates equal to 10%, 12%, 15%, 20%, 25%, 30%, 40%, and 50%. Although this list is not nearly complete, these values cover the range of annual rates of retum that seem to prevail during the period in which this book is being written.

TABLES OF INTEREST FACTORS. lnstead of calculating the value of the interest factor needed in a given problem, values are tabulated for a wide variety of interest rates and years. In this appendix, the interest factors are given for interest rates equal to 10%, 12%, 15%, 20%, 25%, 30%, 40%, and 50%. Although this list is not nearly complete, these values cover the range of annual rates of retum that seem to prevail during the period in which this book is being written.

COMMENTS ON THE USE OF THE INTEREST FACTORS. ln using the interest factors, we must be clear as to when the various cash flow transactions represented by P, F, and A occur during the year. The present worth transaction, P, occurs at the beginning of the year. F and A transactions are assumed to be end-of-year cash flows.

Our definitions of the six interest factors were based on 1-year intervals or periods. Actually, interest can be compounded more frequently than annually. Savings accounts are often compounded quarterly. The foregoing interest factors can be adapted to periods other than annual periods. However, for our purposes it will be sufficient and convenient

to maintain the annual compounding convention.

PROBLEMS chapter 3

3.1. Two altemative production methods have been proposed: one a manual method, the other an automatic machine. Data are given in the following table.

Manual Automatic

First cost $15,000 $95,500

Annual operating cost $30,000 $10,000

Salvage value 0 $15,000

Service life (years) 10 7

Use a rate of return of 10% to select the more economical alternative if the two alternatives are equivalent in tems of capability.

3.2. Solve Problem 3.1 using a rate of return of 20%. Why is,the selection of method different from that of Problem 3.1 ?

3.3. A proposed automatic machine is to be used exclusively to produce one type of work part. The machine has a fist cost of $50,000 and its expected service life is 3 years with a salvage value of $20,000 at the end of the 3 years. The machine will be operated 4000 h/yr (two shifts) at $8.00/h (labor, power, maintenance. etc.). lts production rate is 10 units/h. Excluding raw material costs, compute the production cost per unit using a rate of return of 25%.

3.4. The following data apply to the operation of a particular automated manufacturing system :

direct labor rate = $10.00/h

number of operators required = 1

applicable labor factory overhead rate = 50%

capital investment in system = $300,000

service life = 10 years

salvage value = $30,000

applicable machine factory overhead rate = 30%

The system is operated one shift (2000 h/yr). Use a rate of return of 25% to determine the appropriate hourly rate for this worker-machine system.

3.5. Solve Problem 3.4 except using three-shift operation (6000h/yr). Note the effect of increased machine utilization on the hourly rate for the system as compared to the results of Problem 3.4.

3.6. A piece of automated production equipment has a first cost of $100,000. The service life is 6 years, the anticipated salvage value is $10,000. and the annual maintenance costs are $3000. The equipment will produce at the rate of 10 units/h, each unit worth $2.00 in added revenue. One operator is required full time to tend the machine at a rate of $10.00/h. Assume that no overhead rates are applicable. Raw material costs equal $0.20/unit. Use a rate of retum of 20%.

(a) Compute the profit break-even point.

(b) How many hours of operation are required to produce the number of units indicated by the break-even point ?

(c) How much profit (or loss) will be made if 50,000 units/yr are produced ?

3.7. ln Problem 3.6, recompute the break-even point if the applicable overhead rates are 20% for the machine and 40% for labor.

3.8. The break-even point is to be determined for two methods of production, a manual method and an automated method. The manual method requires two operators at $9.00/h each. Together, they produce at a rate of 36 units/h. The automated method has an initial cost of $125,000, a 4-year service life, no salvage value, and annual maintenance costs of $3000. No labor (except for maintenance) is required to operate the machine, but the machine consumes energy at the rate of 50 kW when running. Cost of electricity is $0.05/kWh. If the production rate for this automated machine is 100 units/h, determine the break-even point for the two methods if a 25% rate of retum is required.

3 9. Determine the unit cost equation as a function of quantity Q for the data given in Problem 3.6.

3.10. Determine the unit cost equation as a function of quantity Q for the data given in Problem 3.7.

3.11. Determine the unit cost equation as a function of quantity Q for the two production methods in Problem 3.8.

3.12. For the manual method of Example 3.8, three possible ways of implementing the method

were discussed in Section 3.4. The three ways were :

(a) Use two machines to achieve the total hours required.

(b) Use a two-shift operation to achieve the total hours.

(c) Use overtime at time-and-a-half to achieve the total hours.

For each of the three ways, determine the total cost equation and the unit cost equation, indicating the values of Q where the equation changes form. Plot each case. The following ground rules apply: (1) 2000 h of operation per year on regular shift; (2) costs as given in Example 3.8; (3) second shift differential = $0.20/h (the labor rate increment of 25 cents/h applies to the labor rate only. not to overheads); (4) labor rate for overtime is $15.00/h, but overhead costs remain constant.

3.13. A proposal has been submitted to construct a new warehouse with l6,000 ft2 of storage Hour space. Assume that 80% of the floor space in the warehouse is available for storage purposes. The building will cost $500,000 to build and is expected to have a 20-year life with a salvage value at that time of $100.000, Annual maintenance and operating costs will be $120,000. The rate of retum used by the fimt in this problem is 25%. This rate applies to investments in building or in inventory.

(a) For a given item that costs Sl25.00 to purchase and requires 5 ft2 of floor space, how much will it cost the company to store the item in the warehouse for 3 months? Your answer must consider both storage costs and inventory investment costs.

(b) If the item indicated in pan (a) is typical in size and cost of the company`s inventory stored in the warehouse. determine a value for h, the holding cost rate.

(c) Determine an estimate of the total cost of inventory in the warehouse on an annual basis, assuming that the warehouse is Hlled to its 80% of floor space throughout the year.

3.14. For the data given in Problem 3.13, solve the problem given that a shelving structure is included in the warehouse cost that permits the parts to be stacked vertically six high.

3.15. A work part costing $80 is processed through the factory. The manufacturing lead time for the part is 12 weeks, and the total time spent in processing during the lead time is 30 h for all operations at a rate of $35/h. Non operation costs total $70 during the lead time. The holding cost rate used by the company for work-in»process is 26%. The plant operates 40h/week, 52 weeks per year. if this pan is typical of the 200 parts per week processed through the factory:

(a) Determine the holding cost per part during the manufacturing lead time.

(b) Determine the total annual holding costs to the factory.

(c) If the manufacturing lead time were to be reduced from I2 weeks to 8 weeks, how much would the total holding costs be reduced on an annual basis ?

3.16. A batch of large castings is processed through a machine shop. The batch size is 20. Each raw casting costs $175. There are 22 machining operations performed on each casting at an average operation time of 0.5 h per operation. Setup time per operation averages 5 h. The cost rate for the machine and labor is $40/h. Non operation costs (inspection, handling between operations, etc.) average $5 per operation per part. The corresponding non operation time between each operation averages 2 working days. The shop works five 8-h days per week, 52 weeks per year. The interest rate used by the company is 25% for investing in WIP inventory, and the storage cost rate is 14% of the value of the item held. Both of these rates are annual rates. Determine the following :

(a) Manufacturing lead time for the batch of castings. I

(b) Total cost to the shop of each casting when it is completed, including the holding cost

(c) Total holding cost of the batch for the time it spends in the machine shop as work-in process.

REFERENCES of chapter 3

[1] BLANK, L. T. and A. J. TARQUIN, Engineering Economy. 2nd ed., McGraw-Hill Book Company, New York, 1983.

[2] Groover, M. P., M Weiss, R. N. NAGEL, and N. G. ODREY, lndustrial Robotics : Technology, Programming, and Applications, McGraw-Hill Book Company, New York, 1986, Chapter 12.

[3] MEYER, R. J., “A Cookbook Approach to Robotics and Automation Justification,” Technical Paper MS82-192, Society of Manufacturing Engineers, Dearbom, Mich., 1982.

[4] THUESEN, G. J., and W. FABRYCKY, Engineering Economy, 6th ed., Prentice-Hall, Inc., Englewood Cliffs, N .J., 1984.

3.6 OTHER DIFFICULT-TO-QUANTIFY FACTORS

There are a number of cost components that are more difficult to quantify than the material, labor, machine, and holding costs discussed inthe preceding sections. These costs include :

- Floor space. A difference in production method can have an effect on the amount of floor space consumed at the workcell. Automated methods generally require less floor space than is required using manual methods. lf the accumulated floor space savings of many automated workcells means that new plant construction can be avoided, the financial benefit to the company is substantial. This cost difference can be evaluated by assessing the cost per square foot of building space and multiplying by the floor space occupied by the alternative production methods.

- Product quality. Automated production methods often lead to less scrap and rework by performing the manufacturing process with greater consistency than human workers are capable of. One of the automation strategies discussed in Chapter 2 involved the use of automated inspection to achieve closer agreement between manufactured product and design specifications. The amount of the savings is difficult to estimate. lf a current manual method produces a high fate of scrap, the potential exists for significant improvements in quality through automation. lt should be possible to include the effect of scrap into the analysis as we did in our production rate formulas in Chapter 2.

- Customer delivery. Different production methods provide different manufacturing lead times. which directly influences customer delivery. Customers who appreciate faster deliveries tend to order more from vendors who can respond quickly. Assessing the value of manufacturing lead times in terms of customer satisfaction and the resulting increases in volume of business is difficult.

- Safety One of the reasons for automating given in Chapter l was safety. Removing the worker from a hazardous environment improves safety conditions. What is the financial wonh of that benefit?

- Improved scheduling. lf the number of separate steps required to process the product can be reduced through the use of automated production systems, this should lead to better scheduling in the shop. Fewer separate machines need to be included in the schedule, and cycle times are more consistent. There is a value to the company of this improved scheduling, but it is nearly impossible to evaluate with confidence.

- Corporate image. Finally, a company that is employing innovative new manufacturing methods and technologies generally has a better corporate image. This will often make work easier for the company sales staff.

3.5 COST OF MANUFACTURING LEAD TIME AND WORK-IN-PROCESS

One of the considerations that is often overlooked in an automation proposal is the effect that the automated method will have on manufacturing lead time and in-process inventory. Automation will often result in dramatic reductions in both of these factors by comparison to previous conventional manufacturing methods. In this section we present a method for evaluating the cost of these factors, based on concepts suggested by Meyer [3].

Our definition in Chapter 2 indicated that production typically consists of a series of separate manufacturing steps or operations. An operation time is required for each step, and that time has an associated cost. There is also a time between each operation, at least for most manufacturing situations. which we have referred to as the non operation time, The non operation time includes material handling, inspection, and storage. There is also a cost associated with the non operation time. These time, and costs for a given part can be illustrated graphically as shown in Figure 3.5. At time 1 = 0, the cost of the part is simply its material cost Cm. The cost of each processing step on the part will be the production time multiplied by the rate for the machine and labor. The production time Tp is determined from Eq. (2.5) and accounts for both setup time and operation time. We will symbolize the rate as Co.

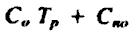

The determination of this rate was illustrated in Example 3.7. The nonoperation costs (e.g., inspection, material handling, etc.) that are related to the processing step will be symbolized by the term Cno. Accordingly, the cost associated with each processing step in the manufacturing sequence will be

The determination of this rate was illustrated in Example 3.7. The nonoperation costs (e.g., inspection, material handling, etc.) that are related to the processing step will be symbolized by the term Cno. Accordingly, the cost associated with each processing step in the manufacturing sequence will be

The cost for each step is shown in Figure 3.5 as a vertical line, suggesting no time lapse. This is a simplification in the graph, since the time between operations spent waiting and in storage is generally much greater than the time for processing, handling, and inspection.

The cost for each step is shown in Figure 3.5 as a vertical line, suggesting no time lapse. This is a simplification in the graph, since the time between operations spent waiting and in storage is generally much greater than the time for processing, handling, and inspection.

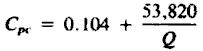

The total cost that has been invested in the part at the end of all operations is the sum of the material cost and the accumulated processing, inspection, and handling costs. Symbolizing this part cost as Cpc, we can utilize the following equation to evaluate it :

![]() where i is used to indicate the sequence of operations. lf we assume that T and C are equal for all nm operations, then

where i is used to indicate the sequence of operations. lf we assume that T and C are equal for all nm operations, then

![]() The pan cost function shown in Figure 3.5 and represented by Eq. (3.3) can beapproximated by a straight line as shown in Figure 3.6. The line starts at time t = 0 with a value = Cm and slopes upward to the right so that its hnal value is the same ast he final part cost in Figure 3.5. The approximation becomes more accurate as the number of processing steps increases. The equation for this line is

The pan cost function shown in Figure 3.5 and represented by Eq. (3.3) can beapproximated by a straight line as shown in Figure 3.6. The line starts at time t = 0 with a value = Cm and slopes upward to the right so that its hnal value is the same ast he final part cost in Figure 3.5. The approximation becomes more accurate as the number of processing steps increases. The equation for this line is

where MLT is the manufacturing lead time for the pan and 1 is the time in Figure 3.6

where MLT is the manufacturing lead time for the pan and 1 is the time in Figure 3.6

In addition to the costs shown in Figure 3.5 (and approximated in Figure 3.6), there are two other sources of costs that should be accounted for. These are the cost of investing in work-in-process and the cost of storing the work-in-process. Both are related to the time that the parts spend in the factory. The investment cost results because the company must pay its operating costs before receiving payment from the customer for the parts. This investment cost is the accumulated cost of the part, depicted as a function of time in Figure 3.5, multiplied by the rate of netum or interest rate, i, used by the company.

In addition to the costs shown in Figure 3.5 (and approximated in Figure 3.6), there are two other sources of costs that should be accounted for. These are the cost of investing in work-in-process and the cost of storing the work-in-process. Both are related to the time that the parts spend in the factory. The investment cost results because the company must pay its operating costs before receiving payment from the customer for the parts. This investment cost is the accumulated cost of the part, depicted as a function of time in Figure 3.5, multiplied by the rate of netum or interest rate, i, used by the company.

The storage cost results because work-in-process takes up space in the factory. In some plants, WIP is placed in a special storage facility (e.g., an automated storage system) between processing steps. In either case, there is a cost of storing the WIP. The magnitude of ~the cost is generally related to the size of the part and how much space it occupies. As an approximation, it can be related to the value or cost of the item stored. For our purposes, this is the most convenient method of valuating the storage cost of the part. By this method, the storage cost is equal to the accumulated cost ofthe pan multiplied by the storage rate, s. The term s is the storage cost as a percentage of the value of the item in inventory.

Combining the interest rate and the storage rate into one factor, we have h = i + s.

The term h is called the holding cost rate. Like i and s, it is a percentage that is multiplied by the accumulated cost of the pan to evaluate the holding cost of investing in and storing work-in-process. Applying the holding cost rate to the accumulated part cost defined by Eq. (3.3) but substituting straight-line approximation in place bf the stepwise cost accumulation in Figure 3.5, we have an equation for total cost per part which includes the WIP investment and storage components :

![]() This can be reduced to simpler form.

This can be reduced to simpler form.

Then

Then

![]() which reduces to

which reduces to

![]() The holding cost is the last term on the right-hand side.

The holding cost is the last term on the right-hand side.

![]() Figure 3.7 shows the effect of adding the holding cost to the material, operation, and non operation costs of a part or product during production in the plant.

Figure 3.7 shows the effect of adding the holding cost to the material, operation, and non operation costs of a part or product during production in the plant.

EXAMPLE 3.10

The cost of the raw material for a certain part is $100. The part is processed through 20 processing steps in the plant and the manufacturing lead time is l5 weeks. The production time per processing step is 9.8 h and the machine and labor rate is $25.00/h. Inspection, material handling, and related costs average $10 per processing step by the time the pan is finished. The interest rate i used by the company is 20% and the storage rate 5 = 13%. Determine the cost per part and the holding cost.

Solution :

The material cost, operation costs, and non operation costs are, by Eq. (3.3),

Cp = $100 + 20 ( $25.00/h x 0.8 h + $10) = $700/piece

To compute the holding cost, first calculate C1 :

![]() Next. determine the holding cost rate h = 20% + 13% = 33%. Expressing this as a weekly rate h = ( 33% ) / ( 52 weeks ) = 0.6346%/week = 0.006346/week. According to Eq. (3_6).

Next. determine the holding cost rate h = 20% + 13% = 33%. Expressing this as a weekly rate h = ( 33% ) / ( 52 weeks ) = 0.6346%/week = 0.006346/week. According to Eq. (3_6).

The $38.08 represents over 5% of the cost of the part. yet the holding cost is usually not included directly in the company’s evaluation of part cost. Rather, it is considered to be overhead. Suppose that this is a typical part for the company, and 5000 similar parts are processed through the plant each year; then the annual inventory cost for WIP = 5000 X $38.08 = $190,400, lf the manufacturing lead time could be reduced to half its current value, this would translate into a 50% savings in WIP holding cost.

The $38.08 represents over 5% of the cost of the part. yet the holding cost is usually not included directly in the company’s evaluation of part cost. Rather, it is considered to be overhead. Suppose that this is a typical part for the company, and 5000 similar parts are processed through the plant each year; then the annual inventory cost for WIP = 5000 X $38.08 = $190,400, lf the manufacturing lead time could be reduced to half its current value, this would translate into a 50% savings in WIP holding cost.

3.4 UNIT COST OF PRODUCTION

ln Examples 3.8 and 3.9, one of the complications in the problems was the difference in production rates for the two altematives. The automated method outproduced the manual method, which is often the case in comparing automation against manual production. To help decide between the altematives, it is often useful to determine the unit cost of production for the two (or more) methods under consideration. The unit cost for a certain operation is the total cost of production divided by the number of units produced. The total cost of production includes both fixed and variable costs. Accordingly, because of the Exed portion of the cost of production, the unit cost will varyas a function of annual output Q. As the annual output increases, the unit cost decreases. Using the manual production method from Example 3.8 to illustrate, dividing the total cost equation by the quantity Q, we get the unit cost equation, which we will symbolize by Cpc, (cost per piece) :

![]() Similarly, the unit production cost for the automated method of Example 3.9 is given by

Similarly, the unit production cost for the automated method of Example 3.9 is given by

The two relationships are plotted as a function of Q in Figure 3.4. Note that the unit costs are equal at the previously detennined break-even point of Example 3.9 (56,575 units per year).

The two relationships are plotted as a function of Q in Figure 3.4. Note that the unit costs are equal at the previously detennined break-even point of Example 3.9 (56,575 units per year).

ln subsequent chapters we will sometimes use the unit cost as a measure of performance for a production system. The reader should recall that these unit costs are calculated under assumed conditions of annual cost and production rate. As indicated in Figure 3.4, the actual cost per unit of production is strongly dependent on the level of annual output.

One other observation about Examples 3.8 and 3.9 is that the total cost equations for the two alternatives ignore certain practical realities that might influence how the production methods are implemented. For both methods, the number of hours of operation were calculated at the various break-even points. ln the case of the manual method, the number of annual hours of operation at the proht break-even point = 3276 h. This is greater than the number of hours nomally worked by one person per year (40/week x 50 weeks/yr = 2000 h/yr). Will the extra hours be achieved by using two machines, or by using two shifts on one machine, or by working overtime by one production worker ? ln each instance, there are additional costs which are not included in the total cost equation. lf two machines are used, the capital cost (fixed cost) is doubled. lf two shifts are used, the worker on the second shift will probably be paid at a higher rate. and there will be other additional costs if the plant does not normally operate a second shift. lf overtime is used to achieve the 3276 annual hours of operation, the cost will increase, as the overtime rate is higher (typically time-and-a-halt) than the regular shift rate. Problem 3.12 requires the reader to determine the total cost equation and unit cost equation for the three alternatives described here.

ln the case of the automated production machine. the number of hours of annual operation to reach the profit break-even point is 1201.3 h, well under 2000 h/yr. lf the company operates the machine at that point or only slightly above, it will be running below capacity and the utilization will be low. ln this case, the company might want to consider ways of increasing demand for the product in order to raise the machine utilization.

ln the case of the automated production machine. the number of hours of annual operation to reach the profit break-even point is 1201.3 h, well under 2000 h/yr. lf the company operates the machine at that point or only slightly above, it will be running below capacity and the utilization will be low. ln this case, the company might want to consider ways of increasing demand for the product in order to raise the machine utilization.

These complicating factors must be considered when alternative production methods are compared in a real-life industrial setting.

3.3 BREAK-EVEN ANALYSIS

Break-even analysis is a method of assessing the effect of changes in production output on costs, revenues, and profits. lt is most commonly conceptualized in the form of a break-even chart. To construct the break~even chart, the manufacturing costs are divided into fixed costs and variable costs. The sum of these costs is plotted as a function of production output. To plot the total cost, the variable cost per unit change in output must be determined. Revenues can also be plotted on a break-even chart as a function of production output.

Break-even analysis can be used for either of two main purposes :

1. Profit analysis. In this case the break-even chart shows the effect of changes in output on costs and revenues. This gives a picture of how profits (or losses) will vary for different output levels. The break-even point is the output level at which total costs equal revenues and the profit is zero. An example of a break-even chart used for profit analysis is shown in Figure 3.2.

2. Production method cost comparison. In this case the break-even chart shows the effect of changes in output level on the costs of two (or more) different methods of production. The break-even point for this chart is the output level at which the costs for the two production methods are equal, (When more than two production methods are plotted on the same chart. there will be a break-even point for each pair of production methods.) Figure 3.3 shows a break-even chart used for production method cost comparison.

We will illustrate the two types of break-even analysis by means of two examples.

EXAMPLE 3.8

This example illustrates the use of a breakeven chart for profit analysis. A manually operated production machine costs $66.063. It will have a service life of 7 years with an anticipated salvage value of $5000 at the end of its life. The machine will be used to produce one type of part at a

rate of 20 units/h. The annual cost io maintain the machine is $2000. A machine overhead rate of 15% is applicable to capital cost and maintenance. Labor to nm the machine costs $10.00/h and the applicable overhead rate is 30%. Determine the profit break-even point if the value added is $1.00/unit and the rate-of-retum criterion is 20%.

Solution:

Solution:

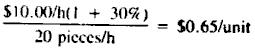

Let Q be the annual level. Variablc cost is labor cost, including applicable overhead. divided by production rate.

The variable cost as a function of Q is 0.65Q.

The variable cost as a function of Q is 0.65Q.

The annual fixed cost is figured on the machine investment plus the maintenance. First, ignoring overhead, we have

UAC = 66,063 ( A/P, 20%, 7 ) + 2000 – 5000 ( A/F. 20%, 7)

= $19.939

Adding the 15% overhead, the fixed cost = $22,930.

The sum of the fixed and variable costs provides the total cost equation as a function of Q:

total cost = $22,930 + 0.65Q

Revenues as a function of Q are the product of value added per unit multiplied by Q. Reve nues = $1.00Q. This is plotted in Figure 3.2. The break-even point occurs where the revenue line intersects the total cost line, To calculate the break-even point, the following equation can be set

up :

profit = 1.00Q – 22.930 – 0.65Q = 0

1.00Q = 53,820 + 0.104Q

0.896Q = 53,820

Q = 60,067 units/yr

This would require 1201.3 h of operation per year.

3.2 COSTS IN MANUFACTURING

Fixed and variable costs

Manufacturing costs can be divided into two major categories, fixed costs and variable costs. The difference between the two is based on whether the expense varies in relation to the level of output.

A fixed cost is one that is constant for any level of production output. Examples of hxed costs include cost of the factory building, insurance, property taxes, and the cost of production equipment. All of these fixed costs can be expressed as annual costs. Those items that are capital investments (e.g., factory building and production equipment) can

be converted to their equivalent uniform annual costs by the methods of the preceding section.

A variable cost is one that increases as the level of production increases. Direct labor costs (plus fringe benefits), raw materials, and electrical power to operate the production machines are examples of variable costs. The ideal concept of variable cost is that it is directly proportional to output level. When fixed and variable costs are combined, we get the total cost of manufacturing as a function of output. A general plot of the relationship is shown in Figure 3.1.

Overhead costs

Overhead costs

Classification of costs as either fixed or variable is not always convenient for accountants and finance people. Fixed costs and variable costs are valid concepts, but the financial specialists of a manufacturing firm usually prefer to think in terms of direct labor cost, material cost, and overhead costs. The direct labor cost is the sum of the wages paid to

the people who operate the production machines and perform the processing and assembly operations. The material ws! is the cost of all the raw materials that are used to produce the Hnished product of the firm. ln terms of fixed and variable costs, direct labor and material costs must be considered as variable.

Overhead costs are all the other costs associated with running a manufacturing firm. Overhead can be divided into two categories : factory overhead (sometimes called factory expense) and corporate overhead. Facloqv overhead includes the costs of operating the factory other than direct labor and materials. The types of expenses included in this category are listed in Table 3.l. lt can be seen that some of these costs are variable whereas others are hxed. The corporate overhead cost is the cost of running the company other than its manufacturing activities. A list of many of the expenses included under corporate overhead is presented in Table 3.2. Many manufacturing limis operate more than one plant, and this is one of the reasons for dividing overhead into factory and corporate categories.

FACTORY OVERHEAD. The overhead costs of a firm can amount to several times the cost of direct labor. The overhead can be allocated according to a number of different bases, including direct labor cost, direct labor hours, space, material cost, and so on. We will use direct labor cost to illustrate how factory overhead rates are determined. Suppose that the total cost of operating a plant amounts to $900,000 per year. Of this total, $400,000 is direct labor cost. This means that $500,000 is’ indirect or overhead expense : plant supervision, line foremen, annual cost of equipment, energy, maintenance personnel, and so on. The factor overhead rate for this plant would be figured as

![]()

TABLE 3.1 Typical Factory Overhead Expenses

Plant supervision Applicable taxes

Line foremen Insurance

Maintenance crew Heat

Custodial services Light

Security personnel Power for machines

Tool crib attendant Factory cost

Materials handling crew Equipment cost

Shipping and receiving Fringe benefits

TABLE 3.2 Typical Corporate Overhead Expenses

Corporate executives Applicable taxes

Sales personnel Cost of oftice space

Accounting department Security personnel

Finance department Heat

Legal counsel Light

Research and development Air conditioning

Design and engineering Insurance

Other support personnel Fringe benefits

Overhead rates are often expressed as percentages, so this equals 125%. This rate could be applied to a particular production job, as illustrated in Example 3.6.

CORPORATE OVERHEAD. The corporate overhead rate can be detemined in a manner similar to that used for factory overhead. We will use an oversimplified example to illustrate. Suppose that the firm operates two plants with direct labor and factory overhead expenses as follows :

Plan 1 Plan 2 Total

Direct labor $400.000 $200,000 $600,000

Facuory expense $500,000 $300,000 $800,000

Total cost $900.000 $500,000 $1,400,000

ln addition, the cost of management, sales staff, engineering, accounting, and so on, amounts to $960,000. The corporate overhead rate would be based on the total direct labor of the two plants :

![]() Overhead rates, both factory and corporate, are simply a means for allocating expenses that are not directly associated with production. The principal concem in this book will be with determining the appropriate allocation of factory expenses, not corporate overhead.

Overhead rates, both factory and corporate, are simply a means for allocating expenses that are not directly associated with production. The principal concem in this book will be with determining the appropriate allocation of factory expenses, not corporate overhead.

EXAMPLE 3.6

A batch of 50 parts is to be processed through the factory for a particular customer. Raw materials and tooling are supplied by the customer. The total time for processing the parts (including setup

and other direct labor) is 100 h. Direct labor cost is $9.00 per hour. The factory overhead rate is 125% and the corporate overhead rate is 160%. Compute the cost of the job.

Solution:

(1) The direct labor cost for the job is

( 100 h ) ( $9.00/h ) = $900

(2) The allocated factory overhead charge, at 125% of direct labor, would be

( $900 ) ( 1.25 ) = $1125

(3) The allocated corporate overhead charge, at 160% of direct labor, would be

( $900 ) (1.60 ) = $1440

lnterprelation : (1) The direct labor cost of the job, representing actual cash spent on the customer’s order, is $900.

(2) The total factory cost of the job, including allocated factory overhead, is $900 + $1125 = $2025. To evaluate alternative production methods, at least some of the factory overhead expenses should be included in the cost comparison.

(3) The total cost ofthe job. including corporate overhead, is $2025 + $1440 = $3465. To price the job for the customer, and to earn a profit over the long run on jobs like this, the price would have to be greater than $3465 For example, if the company uses a 10% markup, the price quoted to the customer would he ( 1.10)($3465) = $3811.50.

Cost of equipment usage

The trouble with overhead rates as we have developed them is that they are based on direct labor cost alone. A machine operator who runs an old, small engine lathe will be costed at the same overhead rate as the operator who runs a modem NC machining center representing a $250,000 investment. Obviously, the time on the automated machine should be valued at a higher rate. lf differences between rates of different production machines are not recognized, manufacturing costs will not be accurately measured by the overhead rate structure.

To overcome this difficulty, it is appropriate to divide production costs (excluding raw materials) into two components : direct labor and machine cost. Associated with each will be the applicable factory overhead. These cost components will apply not to the aggregate factory operations but to individual production work centers. A work center

would typically be one worker-machine system or a small group of machines plus the labor to operate them.

The direct labor cost consists of the wages paid to operate the work center. The applicable factory overhead allocated to direct labor might include fringe benefits and line supervision. These are factory expense items which are appropriately charged as direct labor overhead.

The machine cost is the capital cost of the machine apportioned over the life of the asset at the appropriate rate of retum used by the firm. This provides an annual cost that may be expressed as an hourly rate (or any other time unit) by dividing the annual cost by the number of hours of use per year. The machine overhead rate is based on those factory expenses which are directly applicable to the machine. These would include power for the machine, floor space, maintenance and repair expenses, and so on. ln separating the applicable factory overhead items of Table 3.1 between direct labor and machine, some arbitrary judgment must be used.

EXAMPLE 3.7

The determination of an hourly rate for a given work center can best be illnstrated by means of an example. Given the following :

direct labor rate = $7.00/h

applicable labor factory overhead rate = 60%

capital investment in machine = $100,000

service life = 8 years

salvage value = zero

applicable machine factory overhead rate = 50%

rate of return used 10%

The machine is operated one 8-h shift per day, 250 days per year. Determine the appropriate hourly cost for this worker-machine system.

Solution :

The labor cost per hour is $7.00 ( 1 + 60% ) = $11.20/h. The machine cost must first be annualized :

UAC = 100,000 ( A/P, 10%,8 )

= 100,000 ( 0.18744 ) = $18,744/yr

The number of hours per year is 8 X 250 = 2000 hr/yr. Dividing the $18,744 by 2000 gives $9.37/h. Applying the 50% overhead rate, the machine cost per hour is $9.37 ( 1 + 50%) = $14.06/h.

So the

total work center rate = $11.20 + $14,06

= $25.26/h

ln subsequent chapters there will be problems in which an hourly rate must be applied to a particular automated production system. Example 3.7 illustrates the general method by which this hourly rate is determined.

3.1 METHODS OF EVALUATING INVESTMENT ALTERNATIVES

There are several methods of evaluating and comparing investment proposals, including the following :

- Payback period method

- Present worth (PW) method

- Uniform annual cost (UAC) method

- Rate-of-return method

In the discussion of these methods in this section, we adopt the convention that positive cash Hows represent money coming in (revenues and/or profits) and negative cash Hows represent money expended (costs).

Payback method

The payback method uses the simple concept that the net revenues derived from an investment should pay back the investment in a certain period of time (the payback period). Let us refer to the net revenue in a given year as the net annual cash How (NACF). If the revenues exceed costs for the year, the NACF is positive. If costs exceed revenues, the NACF is negative.

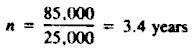

Assuming for the moment that the net annual cash flows are positive and equal from one year to the next, the payback period can be defined as follows :

![]() where IC is the initial cost of the investment project, and n is the payback period (expressed in years).

where IC is the initial cost of the investment project, and n is the payback period (expressed in years).

EXAMPLE 3.1 `

A new production machine costs $85,000 installed and is expected to generate revenues of $55 ,000 per year for 7 years. lt will cost $30,000 per year to operate the machine. At the end of 7 years, the machine will be scrapped at zero salvage value. Determine the payback period for this investment.

Solution:

The NACF = 55,000 – 30,000 = $25,000 per year for 7 years. The IC = 585.000, so the payback period is

The production machine will pay for itself through the net revenues generated in 3,4 years.

The production machine will pay for itself through the net revenues generated in 3,4 years.

In most real~life situations, the net annual cash flows will not be equal year after year. The concept of payback period is nevertheless applicable. Instead of using Eq. (3.1), a summation procedure is used to determine how many years are required for the initial cost to be recovered by the accumulated net annual cash flows. The procedure is best summarized by the following :

![]() where NACF, represents the net annual cash How for year j. The value of n is determined so that the sum of the NACF values equals the IC value.

where NACF, represents the net annual cash How for year j. The value of n is determined so that the sum of the NACF values equals the IC value.

Present worth method

The PW method uses the equivalent present value of all current and future cash flows to evaluate the investment proposal. The future cash flows are convened into their present worths by using the appropriate interest factors. Accordingly, some interest rate must be used in the factors. This interest rate is decided in advance and represents the rate-of-retum criterion that the company is using to evaluate its investment opportunities. If the aggregate present worth of the project is positive, the retum from the project exceeds the rate-of-return criterion. If the present worth of the project is negative, the project does

not meet the rate-of-return criterion.

EXAMPLE 3.2

The data from Example 3.1 will be used here. Assume that the company considering the investment uses a rate-of-retum criterion of 20%. Determine the equivalent present wonh of the proposal.

Solution:

Using the interest factors from the tables in the Appendix, all cash Hows are converted to their present values. The IC is already a present value.

PW = -85,000 + 55,000 ( P/A, 20%. 7 ) – 30,000 ( P/A, 20%, 7 )

= -85,000 + 25,000 ( 3.6046 )

= +$5,115

Since the present worth is positive. we conclude that the retum from the investment exceeds the rate-of-return criterion of 20%. and the project is therefore meritorious.

Uniform annual cost method

The UAC method converts all current and future cash Hows to their equivalent uniform annual costs using the given rate of retum. As with the present worth method, a positive aggregate unifonn annual cost means that the project exceeds the criterion.

EXAMPLE 3.3

Again. the data from Example 3.1 will be used. The problem is to determine the equivalent uniform

annual cost for the project.

Solution:

Using the interest factors from the tables in the Appendix, all cash flows not already expressed as

UAC values are converted to their unifomi annual cost equivalents.

UAC = – 85.000 ( A/P, 20%, 7 ) + 55,000 – 30.000

= -85.000 ( 0.2774 ) + 25.000

= +$1421

Since the UAC value is positive, the actual rate of return is greater than 20%, just as we found using the present worth method.

Rate-of-return method

The rate-of-return method, also called the return-on-investment (ROI) method, goes slightly beyond the PW and UAC methods by actually calculating the rate of return that is provided by the investment. lf the calculated rate is greater than the criterion rate of return, the investment is acceptable.

To determine the retum on investment, an equation must be set up with the rate of return as the unknown. Either the PW method or the UAC method can be used to establish the equation. Then the value of the interest rate i that drives the aggregate PW or UAC to zero is determined.

EXAMPLE 3.4

The data from Example 3.1 will be used to demonstrate computation of the rate of return.

Solution :

A uniform annual cost equation will be set up to illustrate detem1ination of the rate of return.

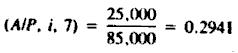

UAC = -85,000 ( A/P, i, 7 ) + 55,000 – 30,000

Scanning the A/P values in the interest tables at n = 7 years for different values of i, we find that

Scanning the A/P values in the interest tables at n = 7 years for different values of i, we find that

(A/P, 20%, 7) = 0,2774 and (A/P, 25%, 7) = 0.3163. By interpolation, a value of i = 22.15% corresponding to our (A/P, i. 7) = 0,2941 is computed.

Comparison of investment alternatives

Any of the four methods can be used to compare investment alternatives. Each method has its relative advantages and disadvantages. The payback method is easy to comprehend but does not incorporate the concept of time value of money into its evaluation. Despite this deficiency, this is a common method used in industry and provides a quick performance measure for the investment proposal. The present worth method is also easy to understand, and it does include interest rates in the evaluation. The UAC method is convenient to use when the service lives of the altematives are different. Awkward adjustments must be made in the PW method when comparing alternatives with different service lives. The advantage of the rate-of-return method, as we saw in Example 3.4. is that it provides a value for the expected retum on the investment. lts disadvantage is that a trial-and-error approach is usually required for problems containing more than one interest factor.

One of the most practical uses of the methods described above is to compare investment alternatives. The following example illustrates how the uniform annual cost method can be used to compare two production methods.

EXAMPLE 3.5

Two production methods, one manual and the other automated, are to be compared using thc UAC method. The data for the manual method are the same data we have used in Examples 3.1 through 3.4. For the automated method. IC = $150,000, the annual operating cost = $5000. and the service life is expected to be 5 years. ln addition, the equipment associated with this altemative will have a salvage value = $15,000 at the end of the 5 years. Revenues from-either alternative will be $55,000 per year. A 20% rate of return is to be used as the criterion. V

Solution :

The equivalent UAC for the manual method has already been calculated. From Example 3.3,

manual UAC = +$1421

For the automated method,

UAC = -150,000 ( A/P, 20%, 5 ) + 55,000 – 5000 + 15.000(A/F, 20%, 5)

= – 150,000 ( 0.3344 ) + 50,000 + 15,000 ( 0.1344 )

automated UAC = +$1856

The automated method has the higher positive net uniform annual cash value. Assuming mat money is available to make the larger investment, it would be selected.

The situation depicted in this example is typical of automation projects: A larger initial investment must be made for the sake of lower annual operating costs. Less labor is required to run the automated process.

ln many of the problems in this book, we will make use of annual costs or costs per other time period (e. g., cost per hour) which can be determined from the annual cost. The annual cost given will often be a calculated equivalent UAC. Let us consider next the types of costs in manufacturing and how these costs can be reduced to their equivalent

annual or hourly rates.